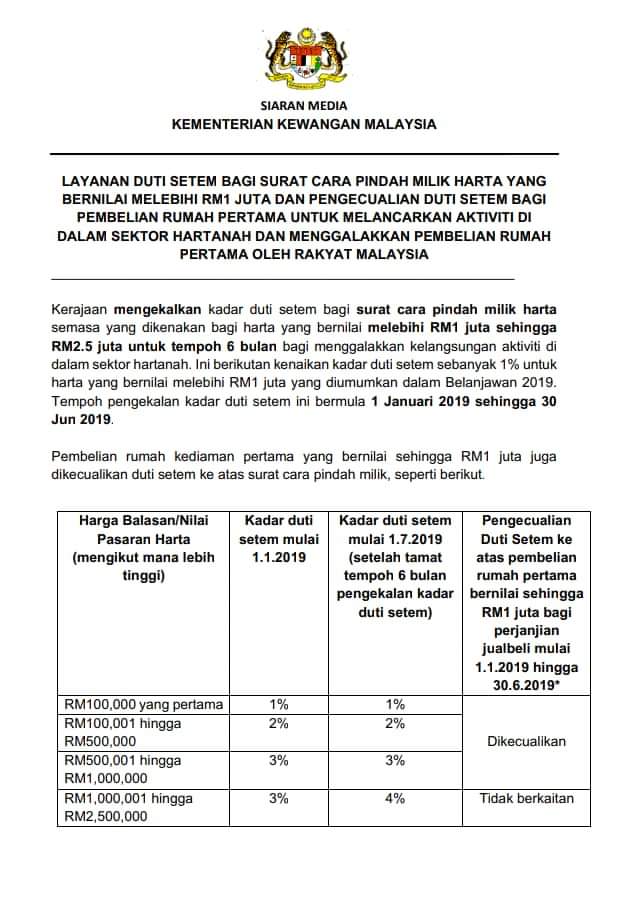

The stamp duty rate for transfer of property valued in excess of RM1000000 until RM2500000 effectively remains at 3 for the instrument of transfer of property that is stamped from 1 January 2019 to 30 June 2019. Land Conversion Charges - 100 exemption.

Stamp Duty Everything You Need To Know About The Uk S Property Acquisition Tax Hlb Poland

150000 out of actual amount of Rs.

. Stamp Duty on Rent to Own Scheme The law applicable is the Stamp Duty Exemption No. Property value not exceeding RM500000 based on the SPA purchase price. A 369 and Stamp Duty Exemption No 4 Order 2019 PU.

Should you have any enquiries please contact Lembaga Hasil Dalam Negeri at its Hasil Care Line at 1-800-88-5436. Home stamp duty exemption order 2019. Mentioned in para 29 Necessary Notification under the provisions of the Bombay Stamp Act 1958 will be issued separately by the Revenue Forest Department.

Now you will get exemption on your expense of Rs. Stamp Duty Exemption No. Ini berikutan kenaikan kadar duti setem sebanyak 1 untuk harta yang bernilai melebihi RM1 juta yang diumumkan dalam Belanjawan 2019.

Stamp duty exemption no5 order 2021 eo. However you will be entitled to an exemption up to a maximum of 450000 for the purchase of residential land once the land meets certain criteria and the relevant exemption application is made. 37 Power Tariff Subsidy.

The exemption in respect of First Time Homeowners is restricted to the purchase of a house or house and land together. Tempoh pengekalan kadar duti setem ini bermula 1 Januari 2019 sehingga 30 Jun 2019. Land Tax - 100 exemption for 7 years.

Provides for stamp duty exemption on any insurance. 4 Order 2019 PU. Maximum of two- thirds of the amount of duty paid at 6 where non-residential land is subsequently developed for residential purposes.

Exemption of Rental Income from Residential Property. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption. Property owner who acquired the property in 2018 but the instrument of transfer is stamped during 112019-3062019 stamp duty would be remitted by 1 on the value RM1 mil provided that the property value does not exceed RM25mil 29.

Stamp Duty Exemption - Instruments of Transfer relating to Indirect Allotment or Redemption of 1 Units under Unit Trust Schemes and 2 Shares under Open-ended Fund Companies U3SOGPN08A Stock Borrowing Relief - Electronic Registration of Stock Borrowing and Lending Agreement U3SOGPN09A. The requirement is as follow. Eligible New Expansion Units of PSI-2013 and PSI-2019 will be eligible for Stamp Duty Exemption during their admissible investment period.

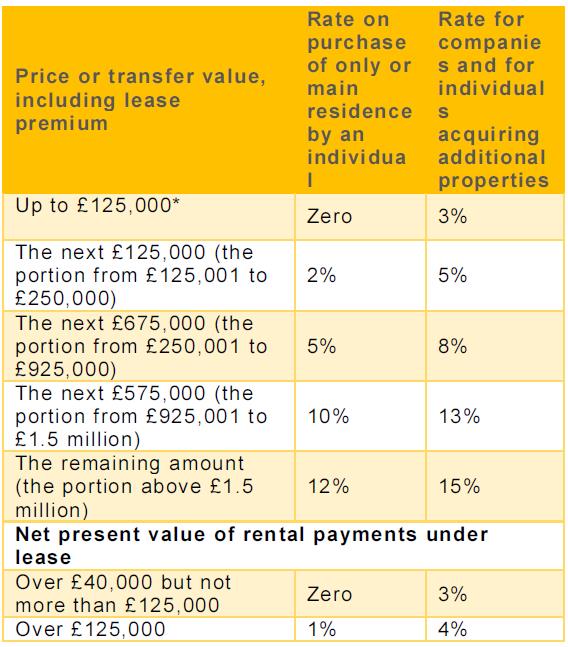

Gallery Exemption For Stamp Duty 2020 Buying A Home. The most attractive package of financial incentives exemptions and subsidies is available for investors under RIPS 2019. 0 on the first 125000 0 2 on the next 125000 2500 5 on the final 45000 2250 total SDLT 4750 Use the SDLT calculator to work.

Stamp Duty - 100 exemption. A 394 dated 26 Dec 2019 and 31 Dec 2019 respectively. The Income Tax Exemption No.

Perlindungan Tenang Products. You cant get exemption in the next years. For example If you bought a house in october 2019 and paid Rs.

200000 and you will have to take exemption in the Income-tax return filing of 2019-20. Both Orders came into operation on 1 Jan 2020. The Stamp Duty Exemption No.

319 provides that any instrument of transfer for the purchase of a residential property under the nhoc 2019 which is valued at more than rm300000 but not more than rm25 million and is executed by an individual is exempted from stamp duty in respect of rm1 million and below of the value of the. 2 Order 2019 the Order was gazetted on 27 February 2019 and is effective for the year of assessment YA 2018. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price.

1 subject to subparagraphs 2 3 and 4 stamp duty shall be exempted in respect of any loan agreement to finance the purchase of residential property under the national home ownership campaign 2019 the value of which is more than three hundred thousand ringgit but not more than two million five hundred thousand ringgit. Section 83D provides for a refund of the difference between the previous non- residential stamp duty rate of 2 and the current rate of 6 ie. Tax deductions us 80 C.

Stamp duty exemption on any instrument in respect of the issuance guarantee and services in relation to the issuance of the Bonds which is executed between 26 February 2019 and 31 December 2019 pursuant to the Stamp Duty Exemption Order 2019. It applies to any instrument of transfer entered into between the transferor and transferee under a rent to own scheme. Guidelines for Application of Stamp Duty Relief under Section 15 and Section 15A of the Stamp Act 1949 2.

Income tax exemption on interest income and technical services fee. Please click here to view the Orders see pages 2 to 14. 2 lakh as stamp duty charges.

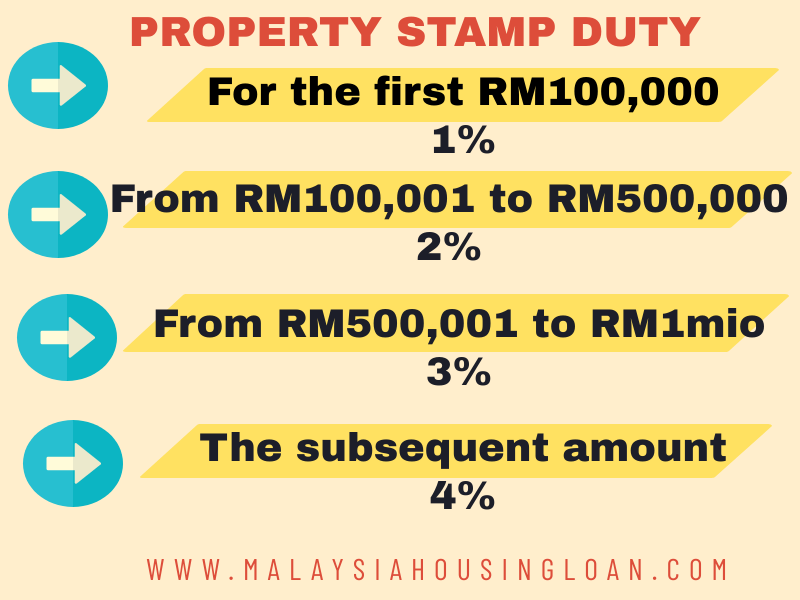

521 provides that any instrument of transfer for the purchase of a residential property under the hoc 2021 which is valued at more than rm300000 but not more than rm25 million and is executed by an individual is exempted from stamp duty in respect of the first rm10 million and below of the. 5 Order 2018 was gazetted on 31 December 2018 to provide a stamp duty exemption on any insurance policies or takaful certificates for Perlindungan Tenang products issued by a licensed insurer or a licensed takaful operator from 1 January 2019 to 31 December 2020 with an annual premium or takaful contribution not. Exemptions Luxury properties Stamp duty of 4 applies on acquisition of property RM1 mil.

Additional Benefits - For Women SCs STs Persons with Disability. PETALING JAYA Jan 31. Exemption For Stamp Duty 2020.

Stamp duty exemption no3 order 2019 eo. The stamp duties on property sales and purchase agreements SPA for properties priced up to RM1 million and for loan agreements of up to RM25 million that come under the National Home Ownership Campaign 2019 HOC 2019 will be waived Finance Minister Lim Guan Eng announced today.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

The 2019 Stamp Duty 大马房地产爆料站property Insight Malaysia Facebook

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Act Extends Ev Stamp Duty Exemption To Electric Motorcycles

Official Gazette Notification On Stamp Duty Exemption In Respect Of Loan Under Home Ownership Campaign 2019 News Articles By Hhq Law Firm In Kl Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

Most Important Stamp Duty Exemptions For Holding And Subsidiary Companies

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets